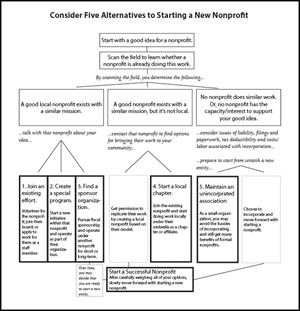

While many people are tempted to incorporate first, there are a number of options for undertaking a new activity without starting a new organization.

Because most people thinking about starting a nonprofit have more passion for the purpose than the paperwork, it is wise to understand the ongoing reporting and record keeping requirements for nonprofits. These obligations represent substantial time and financial requirements and can be an obstacle to success and an unwanted distraction for people wanting to spend their time directly involved in serving people, creating art, or promoting a cause.

Since many nonprofits are formed with high hopes and a few dedicated people and never get off the ground, investing time on the front end to determine the level of interest and availability of funds can help you better understand whether a new organization is needed.

Watch this helpful video

1. Join an existing effort.

Study the list of nonprofits already active in the same subject and geographic area and join their efforts as a volunteer, a board member, or even as staff.

2. Create a special program of an existing effort.

Analyze the list of nonprofits already active in the same area, identify the three most compatible with your ideas, and meet with them to explore creating a special project or initiative and negotiate your involvement. You may have ideas that they would welcome, including resources that may be available to finance the new undertaking. Your activity could be a sponsored project with a level of independence, but without the need for separate books, government reporting, and boards and committees.

3. Start a local chapter of a national or regional organization.

Explore the list of national organizations in the subject area of your interest, and see if a local chapter is needed in your geographic area.

4. Maintain an unincorporated association.

If your effort will be quite local and small, consider remaining an unincorporated association — have meetings and activities but skip the ongoing reporting requirements. Unincorporated associations can operate as a nonprofit; however, donations are not tax-deductible.

Those that choose to remain as an unincorporated association may undertake risk to board members and founders by not incorporating the organization. By incorporating, the organization becomes a legal entity and can only be liable for the assets of the organization. An incident involving an unincorporated organization may put personal assets of board members, volunteers, or others at risk.

5. Find a fiscal sponsor for your organization.

If you are considering creation of a group to finance activities or needs of others, plan to work on a limited-time project, or want to test a program idea first, explore fiscal sponsorship. Fiscal sponsorship, sometimes referred to as fiscal agency, is a way to receive tax-deductible contributions by using the tax-exempt status of another organization as an umbrella.

Fiscal sponsors often provide more than the use of their tax-exempt status. They often co-locate, provide accounting and administrative services, and strategic planning guidance. The sponsored organization will pay a fee to the sponsor for their services, generally around 10 percent of the organization’s revenues.

Fiscal sponsorship is a complex, individualized process. Organizations considering working with a sponsor should first identify several possible sponsors with missions in sync with that of the new organization. Work with each of these organizations to find the best fit in terms of missions, working style, and location. Will the sponsorship be structured to re-grant monies to the new organization? Will the sponsored organization purchase services from its sponsor? At what cost? How will both be assured against tax fraud? It is strongly recommended that both parties consult with legal professionals to ensure their interests are being met in the sponsorship agreement.